If you're planning to launch a membership website, you'll need to connect it to a secure and trustworthy payment processing gateway. Two of the most popular choices are Stripe and PayPal. Our clients often ask us which we would recommend Stripe vs PayPal?

We have experience using both as they are integrated with our membership website solution.

Stripe and PayPal offer payment gateway solutions for accepting online payments. And many web platforms offer both as processing solutions.

Being a long-time player, PayPal has instant name recognition and a high trust factor with millions already having active PayPal accounts.

PayPal offers a number of gateway products but this article will focus on Payments Standard and Payments Pro.

By contrast, Stripe opened shop in 2009 but has quickly gained steam as a favorite of developers due to its ease of use and functionality.

They have many similarities but also some distinct differences.

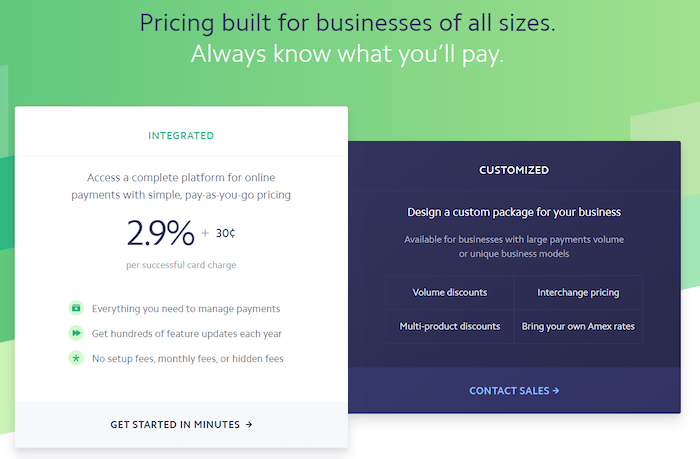

Compare Transaction fees

Stripe charges 2.9% on each transaction + a fixed fee of $0.30 cents on every successfully processed payment originating in the US. Depending on your plan, PayPal fees range from 2.59%-3.49% + a fixed fee of $0.49 cents.

With transactions on non-US cards, the percentage of the processing fee increases. Stripe charges 3.9% and PayPal charges 4.4%.

When opting for PayPal Payments Pro, in addition to the transaction fees, there’s a $30 monthly account fee.

Chargebacks fees

Chargebacks occur when a customer reports to their bank a transaction they don’t agree with or think is fraudulent.

Each payment gateway has a dispute process that allows you to respond with evidence against a claim or to accept it.

If the dispute resolution is in your favor, the transaction amount is returned to your account. If it is not, you will incur a chargeback fee.

Stripe’s chargeback fee is $15.00 while PayPal’s is $20.00.

In addition, if the customer wins the dispute, Stripe will retain all processing fees while PayPal will only return the fixed fee.

Payout schedule

As an anti-fraud measure, Stripe holds payments for seven days before they are released and can be available for pay out to a linked bank account.

Payouts can be scheduled or initiated at your convenience.

PayPal allows instant withdrawal of funds directly to your account.

Neither Stripe or PayPal charges a fee to transfer money to your bank account.

Supported currencies

Stripe is available for business in 47 countries and supports 135+ currencies.

PayPal is available in over 200 countries and supports 25 currencies.

By supporting multiple currencies, this allows you to charge customers in their native currency while receiving funds in yours.

However, when there’s a difference in currencies, the customer may be charged a foreign exchange fee by their card issuer. They may also be charged a fee if their credit card and your business are in different countries.

Recurring subscriptions

Both Stripe and PayPal support recurring subscriptions.

How to test payments

Stripe allows you to test the payment processing before accepting real payments. This is done by setting your Stripe account to test mode and pasting the Secret Test Key into your website.

You can then make trial purchases with these test card numbers using any expiry date, name, CVC, and zip code.

Visa: 4242 4242 4242 4242

Mastercard: 5555 5555 5555 4444

American Express: 3782 822463 10005

Use these cards numbers when testing SCA.

Consult this page for International test card details.

PayPal does have a payment test function called PayPal sandbox but it’s more for the tech savvy.

Customer support

When it comes to Stripe vs PayPal on customer support, Stripe comes out on top.

Stripe’s 24/7 customer support is always available to respond to your queries through multiple channels which include live chat, phone and email.

PayPal has fixed support hours and its support channels only include phone and email. They do promote engaging with their community forum, however, receiving official support is always preferable, especially when dealing with money matters.

Security

Both gateways, are PCI compliant and take security seriously.

Customer’s financial details are processed within the systems of Stripe and PayPal.

Stripe’s entire payment process is securely protected. It forces HTTPS for all services using TLS (SSL). All card numbers are encrypted and stored in a separate hosting infrastructure.

The credit card data entered into your payment form is never sent to your server. Instead, the data is sent directly to Stripe.

With PayPal, a customer’s financial information is never shared, and they pay using only an email address and password.

Checkout experience

Stripe’s seamless checkout experience is simple and straightforward. A customer enters their card details and clicks submit. They never leave your site during the checkout process.

With PayPal Payments Standard, your customer is redirected to PayPal where your customer has to log in to complete payment. Added steps always increase the chance of cart abandonment.

The benefit of PayPal Pro is the ability to control the checkout experience. Instead of customers being redirected to PayPal’s gateway, you can design and host your checkout page for a seamless experience.

Comparison of admin experience

While many articles comparing Stripe vs PayPal, focus on fees, checkout and support, rarely do they ever evaluate one of the most important factors – the admin user experience.

When dealing with customer accounts, being able to easily reference payment details is essential. In both, interface and search functionality, Stripe outperforms PayPal.

Dashboard

Stripe’s dashboard and control panel are clean, modern and intuitive while PayPal’s is cluttered.

Search function

Stripe’s search function is light years ahead of PayPal’s. Whereas a simple search query with PayPal necessitates navigating through multiple filters and screens, Stripe’s search delivers results with a single click.

In conclusion

Both Stripe and PayPal have their own unique benefits, and the best choice depends on your specific needs and preferences. Stripe may be a better choice for businesses that require a high level of customization and flexibility, while PayPal may be a better choice for businesses that need a payment platform that is widely accepted and easy to use.

There is though a benefit to providing choice to customers. If you have a large customer base and the bandwidth to manage two gateways, I would recommend using both options and let your customers choose which payment method suits them best.

However, if you want ease of use, lower fees, combined with maximum functionality, Stripe is the way to go and the gateway we always recommend. In nearly all areas, except for name recognition, Stripe has the edge over PayPal.