Non-profit organizations play a crucial role in society, offering support to those in need. However, small non-profits often struggle with accepting donations due to limited access to banking services like PayPal. Fortunately, there are several alternative payment processing options available. Here’s a detailed guide on the pros and cons of PayPal and tips for finding an alternative solution.

Step 1. Identify your organization's payment processing needs

The right payment processor depends on the types of payments you plan to accept. Many non-profits rely on donations and need a simple way for website visitors to contribute. You might also sell items such as e-books, digital products, or physical goods, either at cost or with proceeds supporting your cause. In these scenarios, you need an online payment processing system unless you're handling payments offline.

For product sales, you can use almost any online processing system, including PayPal, Stripe, Square, and Shopify. Research each option for costs and ease of use for both you and your customers.

For donations, you could offer set amounts (e.g., $20, $100, $200) without allowing visitors to choose their own donation amount. PayPal and others are suitable for this. Alternatively, you may want to allow any donation amount with a minimum required donation. Now is the time to start researching the best options for your online donation needs.

Step 2. Research payment processing alternatives

Paypal

Pros:

Viable for any donation scenario, offers a reduced transaction fee for registered 501(c) charities (2.2% + $0.30 vs. 2.9% + $0.30). PayPal is widely recognized and trusted, making donors more likely to feel secure using it. It's easy to integrate with most websites, and many platforms already support PayPal. If the platform you are using is not integrated with it, you can still set up PayPal Donation buttons on your site. The user experience can be somewhat jarring, though, as the donor is taken off your website and is prompted to sign into PayPal immediately upon clicking the “donate” link.

Cons: Donors are redirected away from your site and must log into PayPal, which can disrupt the user experience. This could potentially result in a loss of donations if the donor gets distracted or decides not to continue with the process.

Stripe

Pros:

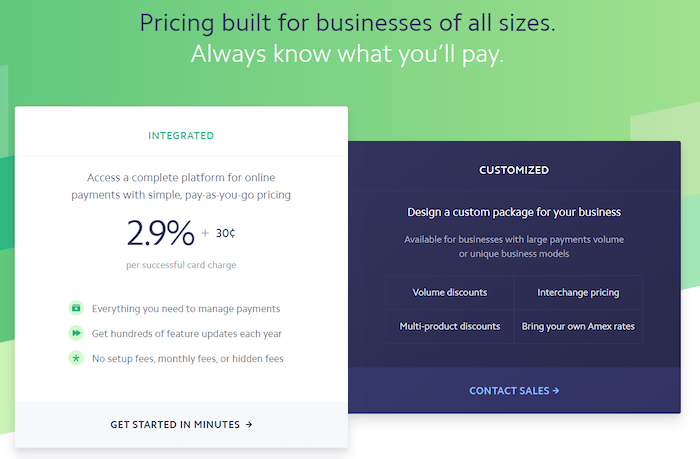

Stripe offers a streamlined user experience with popups or well-designed forms, discounted transaction fee for non-profits (requires nonprofit status and 80% donation processing on Stripe). Stripe's seamless integration keeps donors on your site, reducing the chances of drop-offs. It supports multiple currencies and payment methods, offering flexibility for international donations.

Cons: You'll need integration with a platform like DonorBox for full functionality. Stripe can be more complex to set up compared to PayPal, requiring more technical knowledge and support.

Donorbox

Stripe has an additional benefit due to its integration with a product called DonorBox. This platform allows you to customize the donation process to suit your organization's needs, offering features like donation tiers, goal meters, and donor wall displays. DonorBox also provides flexibility in presenting donation options, minimum donation amounts, recurring donations, donation tracking, and reports.

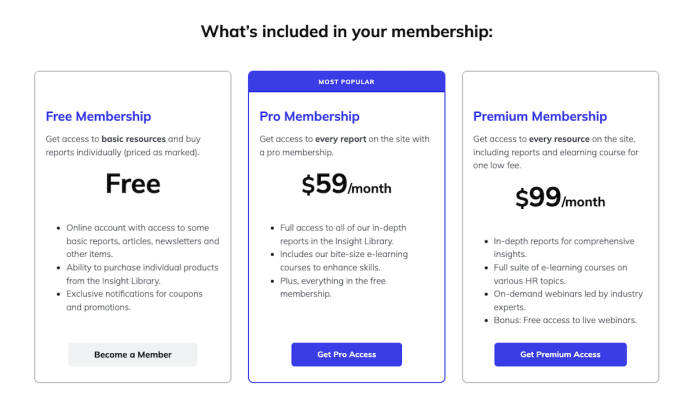

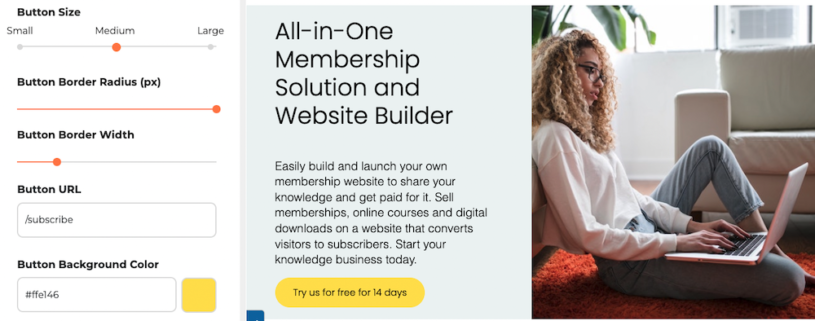

If your website is a SubHub membership website, you can use Stripe or Paypal or both as the platform is integrated with both processors.

Cons:

There is added complexity if used without Stripe. While DonorBox is free to start, it charges a 1.5% platform fee on top of Stripe's fees for the donations processed.

Eventbrite

Pros:

Another type of payment structure is to couple donations with an event. Eventbrite is an event platform that lets you sell tickets at a set price, but also provides a way to donate a voluntary amount in lieu of admission sales. Eventbrite might be a good solution for raising funds through a virtual event.

If you are running events on a regular basis, Eventbrite may be a good choice for you as it also offers advanced features such as late registrations, waitlist management, a customizable order form, confirmation webpage and email, automatic adding of your event to Facebook if desired, and auto emails to attendees. With these features, you can set up reminder emails to go out to attendees at pre-determined time intervals. If you prefer to use a template for your email design, Eventbrite also integrates with Mailchimp. This also means you can capture the contact information of registrants within Mailchimp and set up an autoresponder series to send out after the event.

Cons:

While they don’t offer a reduced transaction fee rate, you do have the option of passing the fee on to the donor, which in a charitable scenario, your donors may not object to. Eventbrite's fees can add up, especially for larger events or higher-priced tickets.

Crowdfunding Programs (ie. Indiegogo, Kickstarter)

Pros:

These platforms are good for specific financial goals or project-based fundraising. Fees are only charged on successfully collected donations. Crowdfunding platforms often come with built-in marketing tools and community support, helping you reach a wider audience and increase your fundraising potential.

Cons:

Kickstarter charges a fee on the entire amount you collect in addition to transaction fees, so it’s not the least expensive choice. But because it’s based on pledges, you will only pay fees on donations that are successfully collected. In addition, if your campaign is unsuccessful, meaning your target was not met and all donations were returned to the donors, you won’t pay any fees.

Step 3. Choose and implement your payment processor

After identifying the best model for your fundraising (event tickets, fundraising campaigns, product sales, or donations), it’s time to implement your choice. For platforms like SubHub, Stripe with DonorBox or PayPal are easy to integrate. SubHub also supports membership and course functionality, which can enhance your donation strategy by offering free courses or memberships with a donation or selling event tickets.

When choosing and implementing your payment processor, look for:

Ease of Integration: Ensure that the payment processor integrates seamlessly with your existing website or platform. Check for available plugins or APIs.

User Experience: Test the donation process to ensure it is smooth and user-friendly. The fewer steps a donor has to take, the better.

Security: Ensure that the payment processor complies with security standards (e.g., PCI DSS) and offers fraud protection.

Cost: Consider the transaction fees and any additional costs associated with the payment processor. Factor in any discounts available for non-profits.

Support: Check the level of customer support provided. Reliable support can be crucial if you encounter technical issues or have questions about the service.

While PayPal remains a popular choice, exploring other online payment options can benefit non-profits to keep the funds coming in. For those using SubHub, sign up for a free trial to explore how Stripe with DonorBox or PayPal can streamline your donation process.