Weather you’re offering stock market tips or personal financial advice, a membership website is the best way to monetize your finance expertise.

Individuals and families are always looking for non-biased advice on topics like education savings, saving for retirement, home financing and more. And a membership site is the perfect venue to offer consistent stock market tips and advice for a monthly or annual fee.

Launching a successful financial membership website may seem daunting if you’re just starting out or just thinking about taking your expertise online. But if you package your knowledge correctly and with your potential customer in mind, you will have a framework that has proven successful in the industry. Here are 5 accepted and expected ways to deliver your knowledge, and provide the impact to inspire your website visitors to join your membership.

Financial Education

Why have you started your financial membership website? To share your knowledge through education, of course. You can do this in a number of ways:

Online Courses

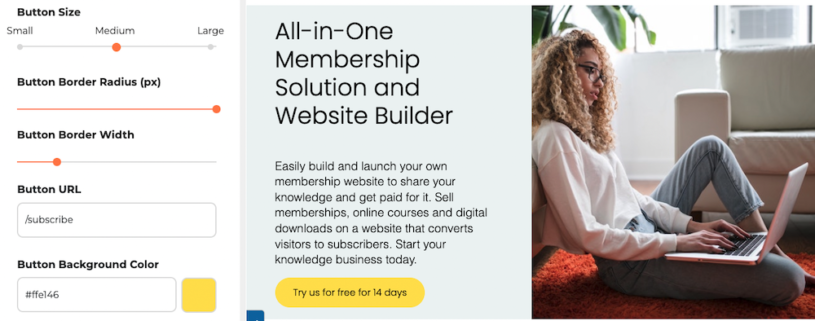

Most membership platforms these days offer a course creation tool. Some of these tools are fairly simple to navigate, while others are much more complex. SubHub’s course creator is easy to use, while at the same time allowing you to offer courses with as many lessons and modules as desired. Some of the more expensive platforms offer quizzes, badges etc. While these items are not built into the SubHub platform, it is super easy to integrate them using third-party hosting platforms.

Webinars

The popularity of webinars these days can’t be overstated. Webinars are extremely versatile and can be effective tools when addressing potential clients at any stage of the buying cycle. For example, if you have created a signature financial coaching program, a webinar is an excellent way to introduce you and the program to a brand new audience. It works just as well as tool to provide details about your program for those who may know who you are but need more information on your services. You can also direct your comments to those who are ready to buy buy creating a special offer on your program for participants.

Articles

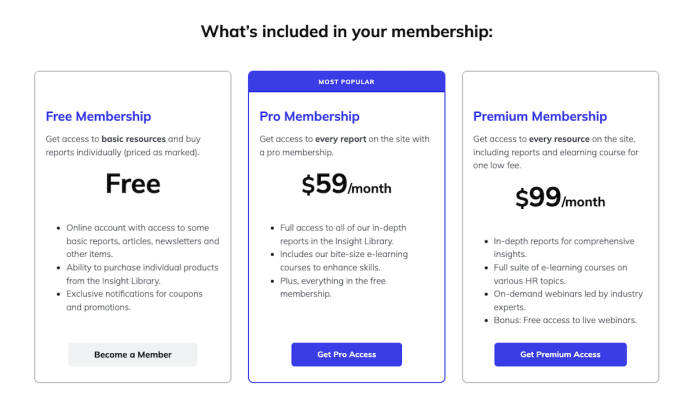

Articles can contain text, images, audio files, videos, PDF’s and more. Financial membership content in the form of articles is quick to compile and straight-forward to offer on most membership website platforms. Article content can be categorized like a blog, but reside behind a paywall. Membership tiers allow you to charge more for certain more specialized content, or for access to live coaching. Content such as a monthly budgeting planner for newlyweds, a tax planner or 5-year retirement strategy are some example that are well-suited to article content.

Access to the Expert

It’s great to offer pre-recorded videos, podcast episodes, or pre-written articles. To take your offerings up a notch, you may want to offer one on one or group access to you, the expert.This can be in the form of coaching calls, group participation calls, or high-level personalized coaching programs that you can charge a premium for. Usually, financial advisors offer a combination of live and recorded access to their expertise.

For example, an evergreen course that allows students to enrol at any time and take the course at their own pace, might be punctuated with a live group call once per month. On that call, you as the expert can provide a Q&A session, answering questions from your members. This adds tremendous value to the course for your students.

Financial Tools

Online financial tools have many benefits besides allowing potential clients to get crucial information they need quickly. Calculators, budgeting templates, investment trackers and calendars are just a few examples. These tools provide a service to clients and visitors that will make your website stand out in their minds later. You can offer them for free to everyone, free only to members, or for a fee. It’s entirely up to you.

Another advantage of online tools is that it keeps your visitors on your website longer, increasing the time that they are interacting with your brand. You will find that most membership website platforms will not offer specific financial tools, but may provide a way to embed such features into a web page. ChatGPT may be a resource for creating a tool for you, even one that is unique to your service.

Community Opportunities

Building a community around shared financial goals and challenges fosters engagement and support. Financial membership websites often include forums, discussion boards, or social networking features where members can interact, share experiences, and learn from each other. Networking opportunities allow individuals to exchange insights, strategies, and encouragement.

Regular Updates

Staying abreast of the ever-evolving financial landscape is crucial, especially in a membership model. Assuming your members are paying on a recurring subscription basis, you will be expected to offer updated content on a regular basis. Successful financial membership sites regularly update their content to reflect current trends, regulations, and best practices. You can also offer bonus content via newsletters, blogs, or curated content. The important thing is to ensure your members have access to the latest information and strategies from your perspective.

An effective financial membership website combines educational resources, personalized tools, expert guidance, community support, and up-to-date content to empower individuals in managing their finances successfully. By focusing on these key characteristics, your website can be an invaluable resource hub for your members’ financial well-being.

To get the maximum out of your marketing budget using Google Analytics, you need to know which strategies do and which don’t work. Once you know what does work, you can invest more time and money into it for a maximum Return On Investment.

To get the maximum out of your marketing budget using Google Analytics, you need to know which strategies do and which don’t work. Once you know what does work, you can invest more time and money into it for a maximum Return On Investment.